ENGAGEMENT

84 percent of those surveyed said they were actively engaging with NAEA content and publications.

Most NAEA members find value in the content and publications NAEA provides. Of those offerings, NAEA’s EA Journal has rated the highest among them, offering CE within every issue along with timely article content.

More than half (53 percent) of current members attend NAEA education programs, while 86 percent of current members rated NAEA’s free continuing education as important.

- Why it matters: In an age where professional education is easy to come by, we strive to offer our members relevant and timely education in a variety of formats and will continue to expand and grow our offerings.

REVENUE

56 percent of members have reported either a substantial or somewhat significant increase in revenue over the past two years.

- Why it matters: As tax laws continue to evolve, we expect enrolled agents to remain in demand due to the complexities that continue to emerge on the tax landscape. We also noted that non-members did not report the same correlation in revenue.

AGE DEMOGRAPHICS

84 percent of member respondents’ ages range between 50 –70 years old.

We have identified a need to attract members of a wider demographic to ensure that we are preparing the next generation of enrolled agents to join the membership to help us evolve in ways that are important to support the practice of enrolled agents.

- Why it matters: This result highlights a major opportunity for the association. While membership numbers range near 10,000, this represents only 15 percent of the greater EA community of nearly 64,000. It will be essential to recruit members that represent the full demographic of the profession so that we may better serve the needs of the profession.

PRACTICE DEMOGRAPHICS

96 percent of members are in tax preparation.

- Why it matters: Most of the members that comprise our demographic prepare taxes. While this is not surprising, it reaffirms the value tax practitioners see in tax practice and prep content we provide. We need to create and offer additional resources to support the needs of enrolled agents and non-EA members as the tax landscape continues to evolve.

51 percent of members surveyed practice IRS Representation.

- Why it matters: With the onset of many tax law changes and the fractured state of the IRS, seasoned practitioners continue to choose NAEA’s National Tax Practice Institute® (NTPI) as the number one resource for learning how to represent clients before the IRS.

- 43% in bookkeeping and 36% in accounting.

53 percent of respondents are sole practitioners while 46 percent work for firms.

- Why it matters: Today’s EAs not only need to remain in compliance but are also busy practitioners running and supporting small businesses.

OPPORTUNITIES

Interest in Options. Below are a few other interesting findings that represent additional opportunities to be considered for future strategic planning efforts.

- Participants with 0‐5 years in the profession, those who are under 40, and who are non‐White are more interested in all new membership options.

- They are more than 20% more likely to be interested in a monthly subscription, and about 20% more likely to be interested in a possible CE/Membership bundle.

- Black/African Americans and international respondents are over 40% more likely than the average respondent to be interested in payment options for membership.

- Those under 50 and Latin/Hispanic and Asians are at least 20% more likely, and those with more than five staff are more than 30% more likely to be interested in firm/company‐level membership.

- Those in the West, are White, or 60 or older, do tax prep only or also specialize in financial planning and/or accounting and bookkeeping are less interested in payment options.

- Those with more than 20 years in the field and are 70 or older are least likely to support the other options (monthly subscription, firm level membership, and CE/membership bundle

OUTLOOK

The outlook for NAEA membership is clear. As we evolve our strategic plans, we will use our most recent research findings to inform future decision making. Enrolled agents remain essential to the continuity of the profession and NAEA will continue to identify ways to continue functioning as an important resource for EAs and the industry. We are encouraged by the feedback offered by those who participated in this survey and will continue our forward momentum into keeping our members prepared for today and to stay ready for what’s dawning on the tax landscape ahead.

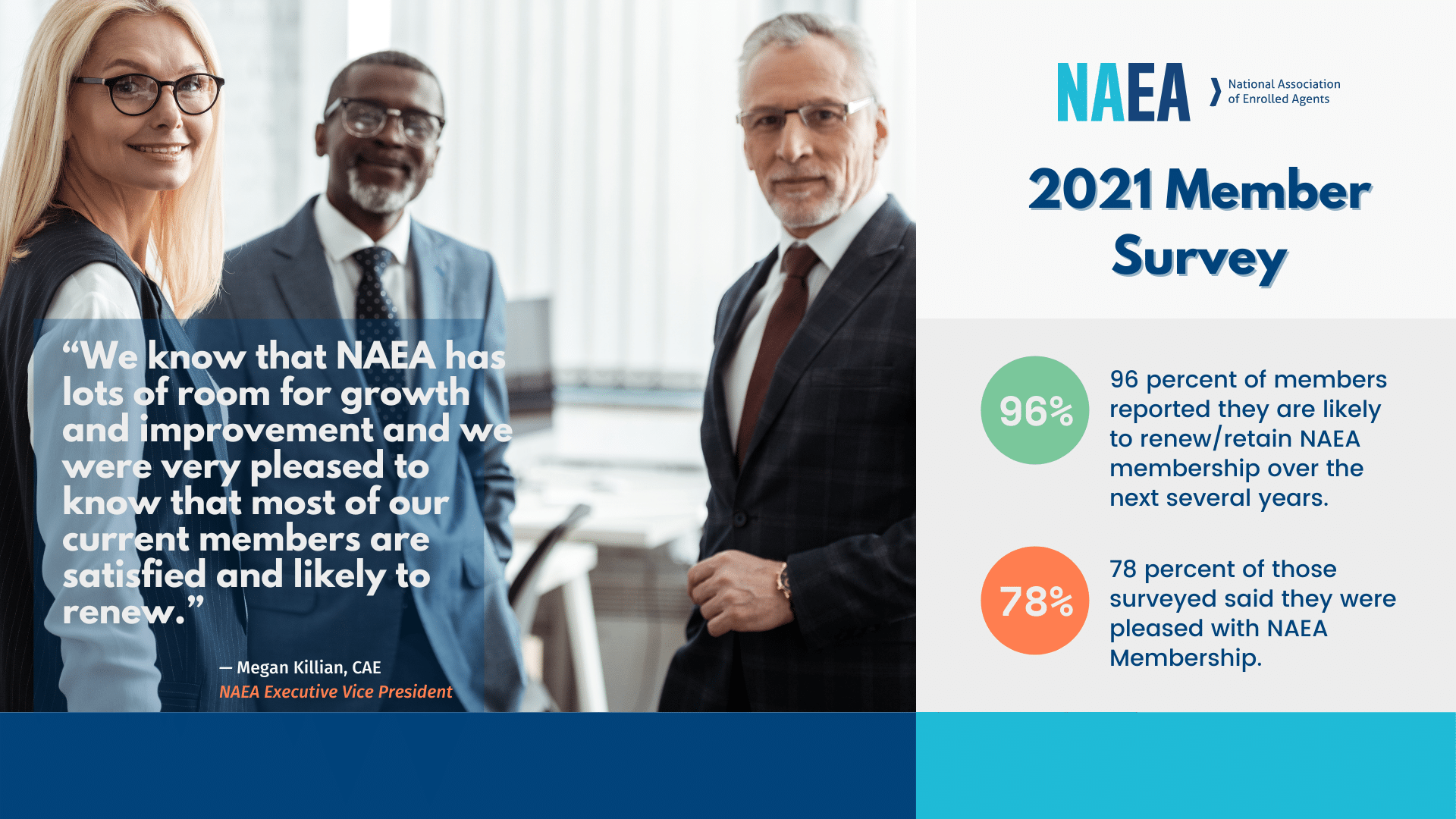

Infographic Summary: Satisfaction & Engagement

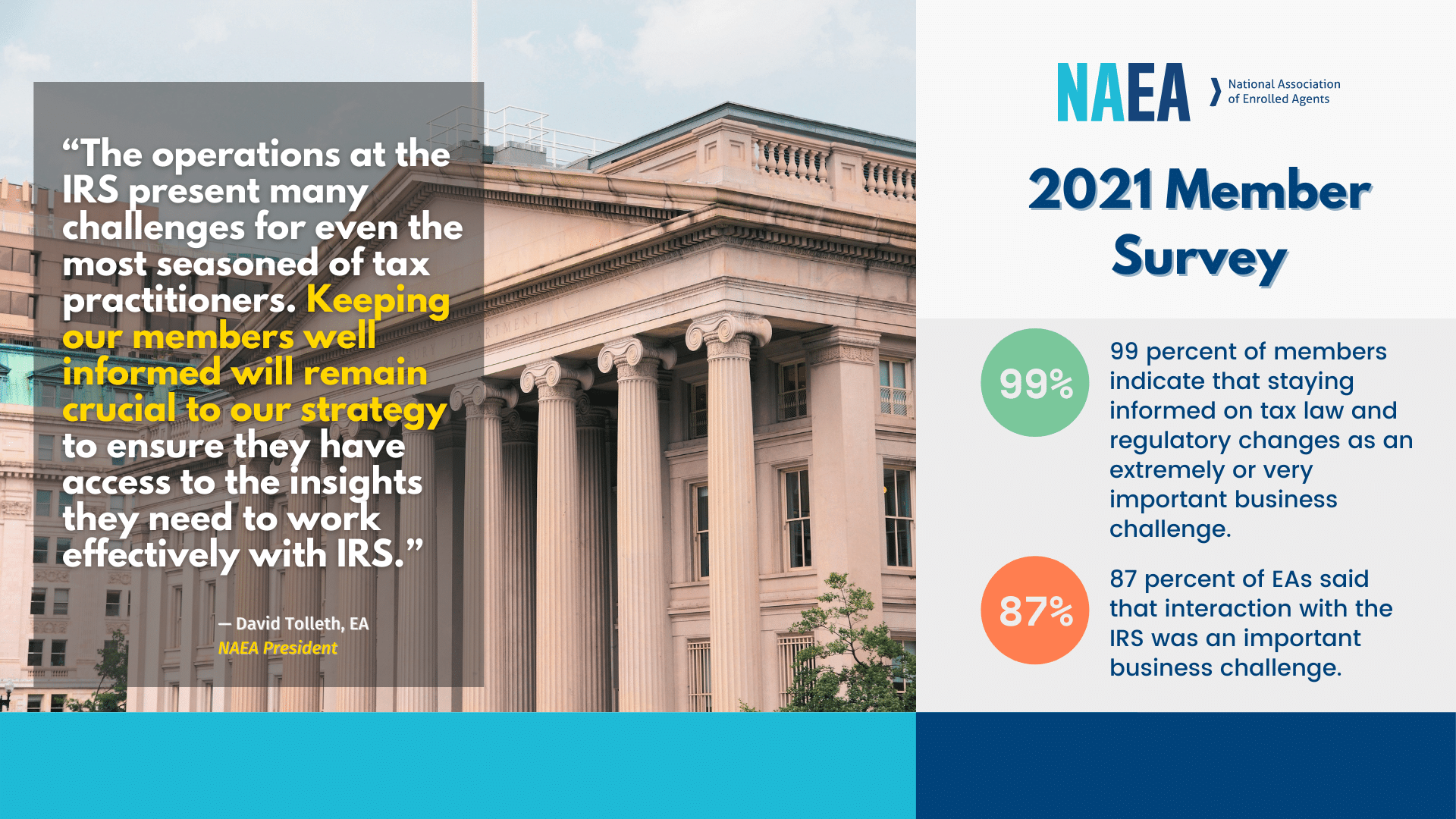

Infographic Summary: Business Challenges, Revenue & Practice